In this extra-long podcast, we review the important new book from MIT’s Andrew McAfee and Erik Brynjolfsson, THE SECOND MACHINE AGE: Work, Progress, and Prosperity in a Time of Brilliant Technologies. The first half is a detailed, Cliffs-Notes version of the book’s arguments for those that have not read it; others may want to skip to our criticisms, which begin in earnest at 00:38. The book details how technological progress is driving growth of both ‘bounty’ and ‘spread,’ and makes a compelling argument for the possibility of technological unemployment occurring. It also makes suggestions for the long and short term, and there is where we have most of our disagreements with the authors.

———————————————————————

A COMPARISON OF NEGATIVE INCOME TAX WITH BASIC INCOME

In the book the authors argue that a negative income tax is preferable to a basic income because a negative income tax will better incentivize people to work. But is there really any substantive difference?

(1) Negative Income Tax

(As described by Friedman/McAfee/Brynjolfsson in the Second Machine Age)

MILTON FRIEDMAN: “Under present law…if you happen to be the head of a family of four, for example, and you have $ 3,000 of income, you neither pay a tax nor receive any benefit from it. You’re just on the break-even point… The idea of a Negative Income Tax is that, when your income is below the break-even point, you would get a fraction of it as a payment “from” the government. You would receive the funds instead of paying them.”

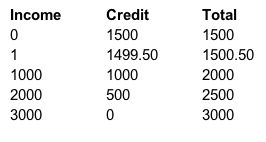

MCAFEE AND BRYNJOLFSSON: “If the negative income tax rate were 50 percent, the person making $2,000 would get $500 back from the government, which is $1,000 (the negative taxable income) times .50 (the 50-percent negative income tax rate), and would thus have total income for that year of $ 2,500. A person with zero income would get $ 1,500 from the government, since they had $ 3,000 of negative taxable income.”

The Math:

- Break-Even Point (BEP): $3000

- Negative Income Tax Rate (Rate): 50%

- Formula: Income + (Rate)(3000 – BEP)

Summary:

Sets an income floor at $1500. Each $1 earned adds $0.50 to your bottom line.

(2) Basic Income

(Calibrated to match the negative income tax example)

The Math:

- Basic Income (BI): $1500

- Tax Rate (Rate): 50%

- Formula: BI + (1-Rate)(Income)

Summary:

Sets an income floor at $1500. Each $1 earned adds $0.50 to your bottom line.

CONCLUSION

As you can see, the Negative Income Tax and Basic Income systems produce very similar results. We’re not sure how Negative Income Tax is supposed to do a better job of incentivizing work.

In particular, we can’t make sense of the book’s claim that “Below the cutoff point in the example…every dollar earned still increases total income by $1.50.” Using their own numbers it seems that every dollar earned below the cut off point only earns $0.50.

There are real potential advantages to a Negative Income Tax: most importantly that it can more easily be implemented using existing infrastructure, a fact which McAfee/Brynjolfsson do acknowledge in the book. We happen to think this particular advantage vastly outweighs any theoretical premium on work.

———————————————————————

Relevant Links

- THE SECOND MACHINE AGE by Andrew McAfee and Erik Brynjolfsson

- Decline of Scarcity article: Can We Create a Future of Autonomy, Mastery, and Purpose?

- YouTube of the Milton Friedman interview referenced in the book

- Review the Future podcast episode 002: Should We Be Worried About Technological Unemployment?